The Reality of Socialism: Denmark | Mini-Documentary

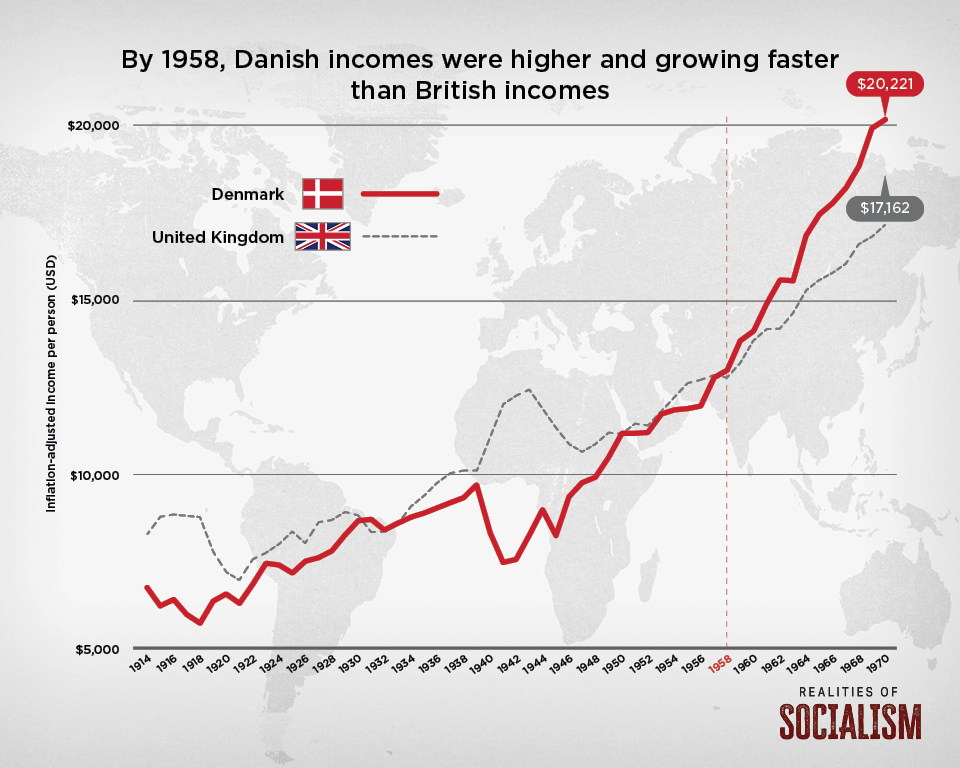

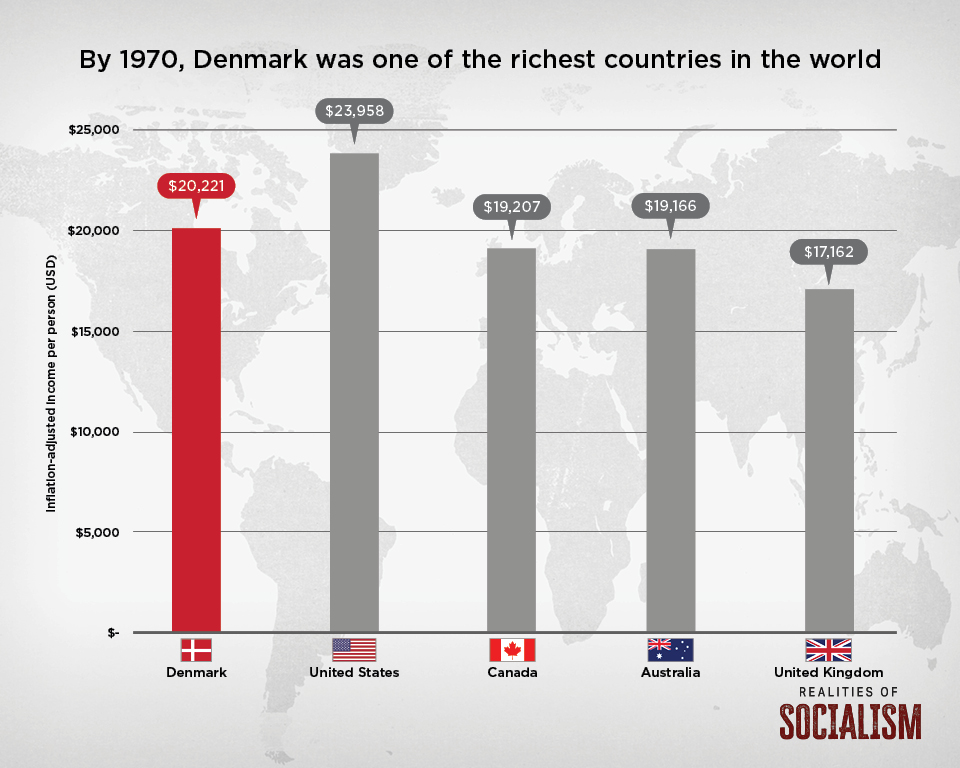

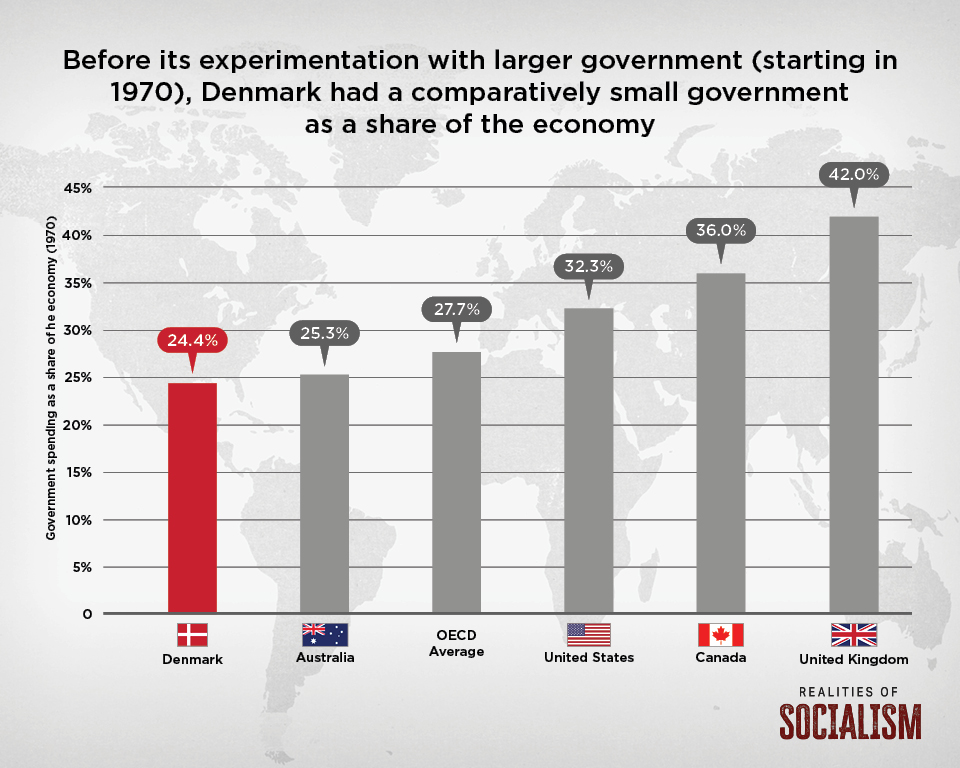

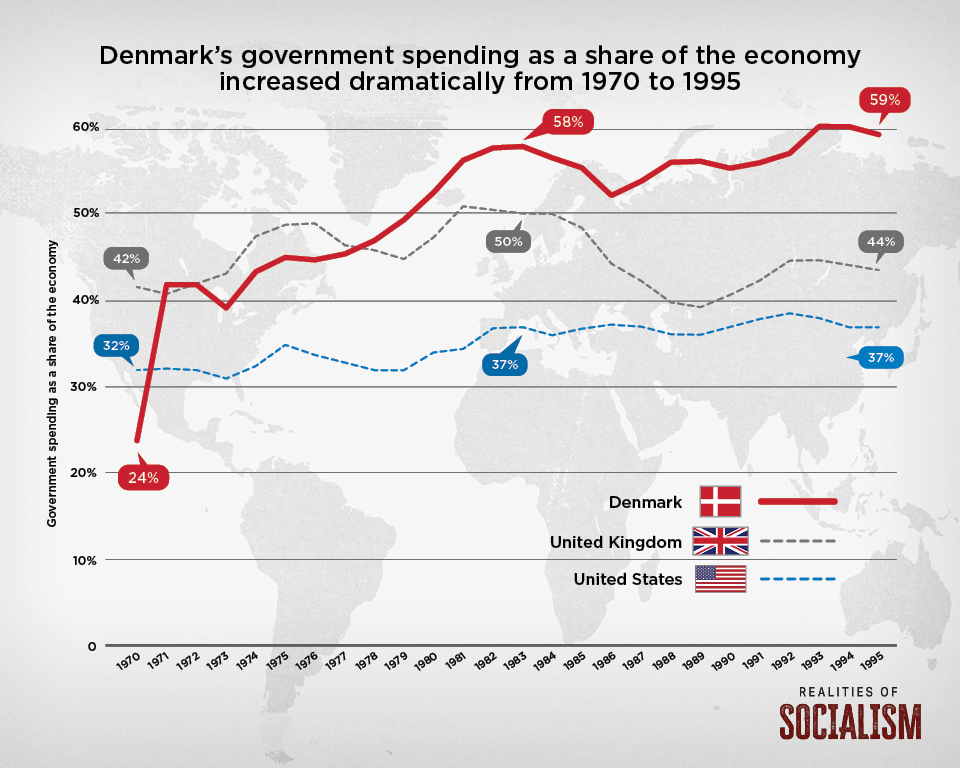

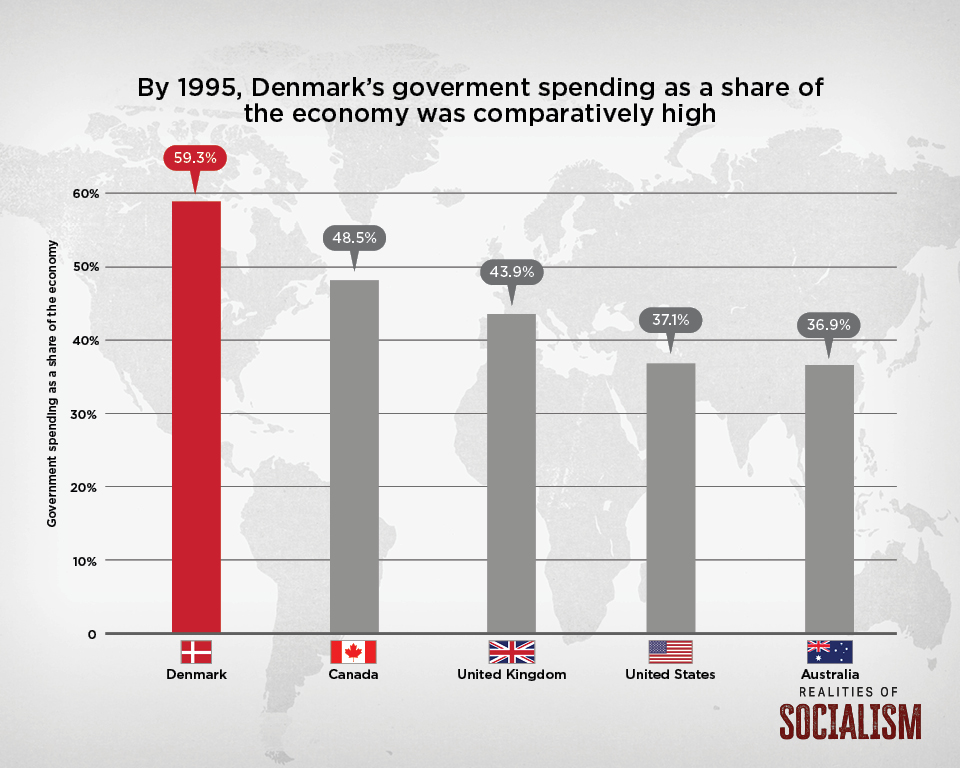

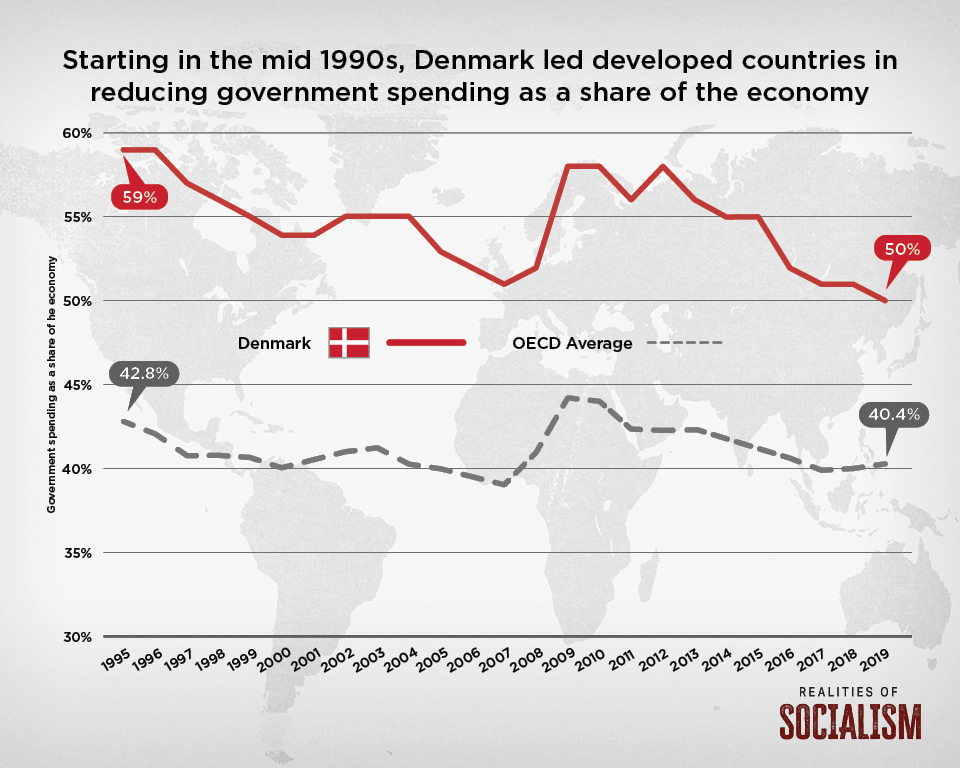

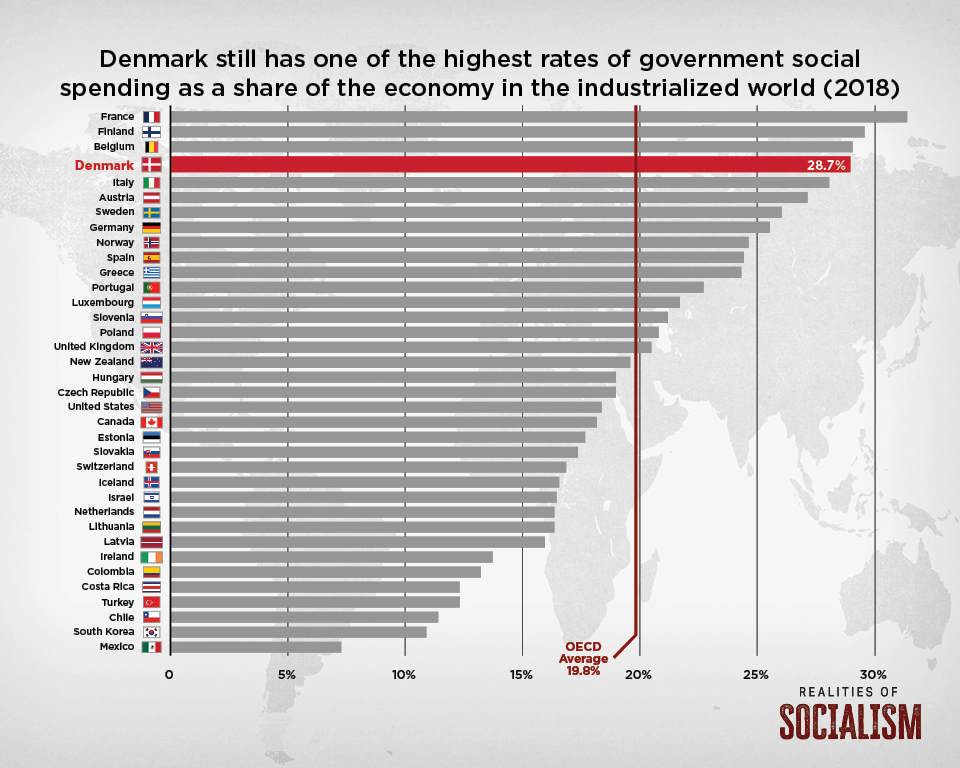

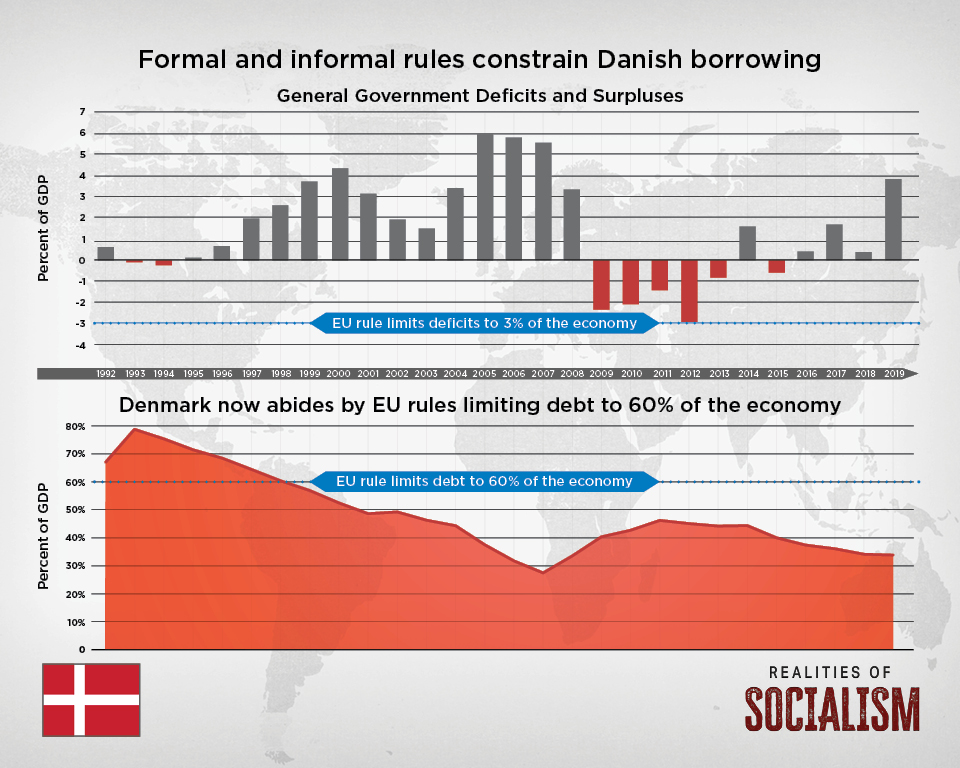

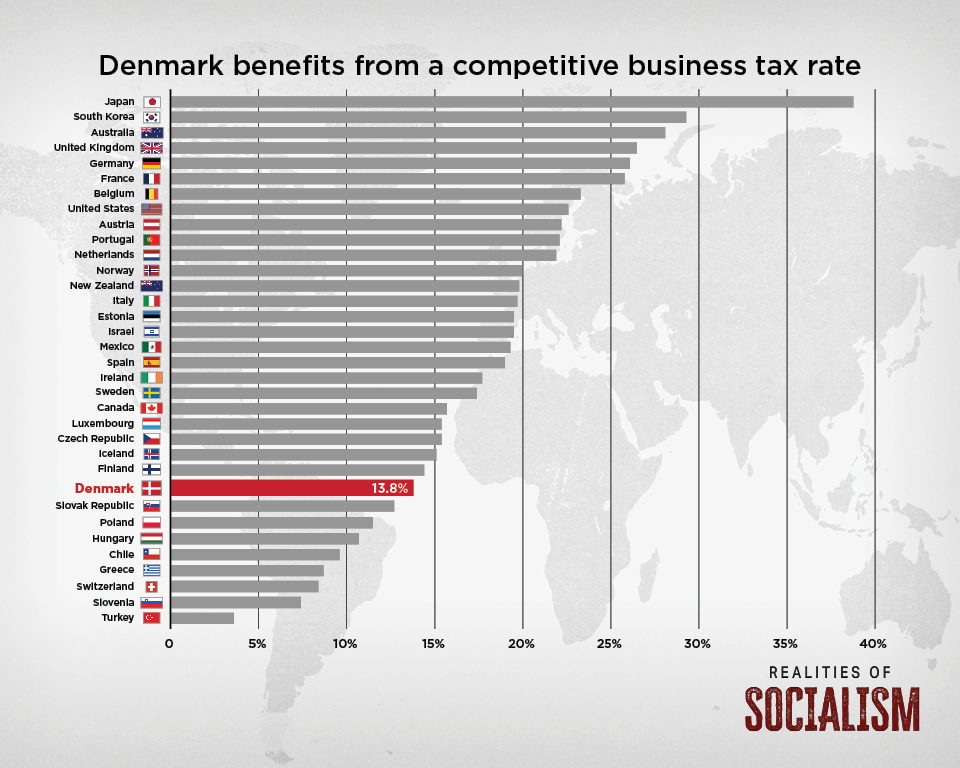

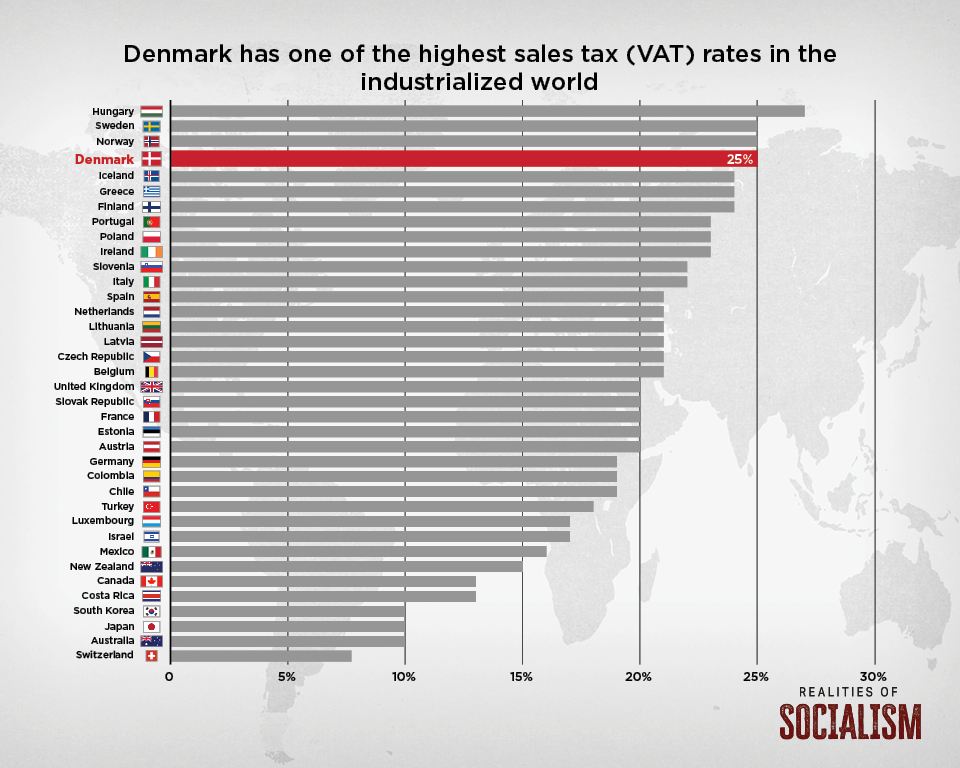

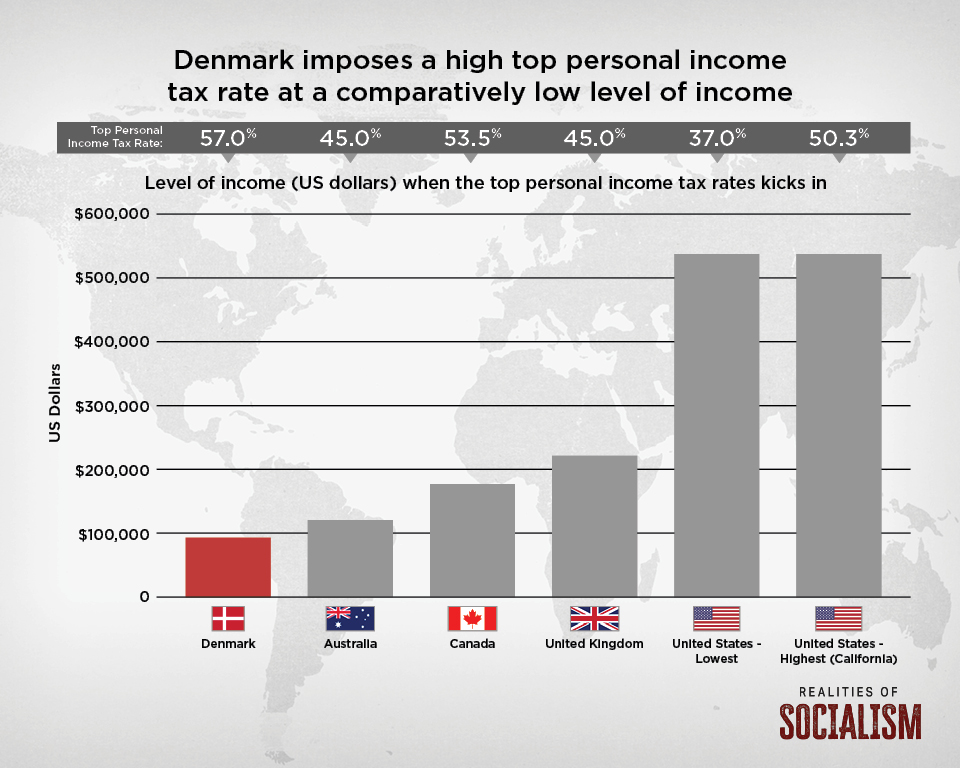

The Wall St. Journal’s Mary O’Grady, along with Fraser Institute Senior Fellows Steven Globerman and Matthew Mitchell, explore the reality of socialism in Denmark. Despite what some people claim, Denmark has a long history of embracing competitive markets, free trade, and limited government. And while Denmark did experiment with socialist policies, including significantly larger government, from the 1970s to 1990s, that ended in crisis in the mid-1990s when the country was beset by high unemployment and soaring inflation. To course correct, the Danish government reduced government spending, balanced its budget, and paid down the large debts it had incurred in the previous decades. Denmark maintains a larger welfare state than many other western countries, but it pays for this welfare state with higher taxes levied on average Danes.

This video is part of a new multimedia project, The Realities of Socialism, by the Fraser Institute in Canada, the Institute of Economic Affairs in the UK, the Institute of Public Affairs in Australia and the Fund for American Studies in the U.S.

More VideosPodcast

Realities of Socialism: What does income support really look like in Denmark?

Matthew D. Mitchell, PhD, Senior Fellow in the Centre for Economic Freedom at the Fraser Institute and co-author of The Road to Socialism and Back, joins host Rosemarie Fike to discuss Denmark’s economic model, and more specifically the country’s approach to income support and when and how exactly the government chooses to intervene.

Videos

Infographics

- All

- Government

- Spending

- Economy

- Taxes

Explore the book

The Free Enterprise Welfare State: A History of Denmark’s Unique Economic Model examines the Danish economic model, including its origins, and draw some important lessons from the experience, including how economic freedom underlies the high standards of living Danes enjoy, how its welfare state is financed with very high taxes on middle-income workers, and how Denmark’s experiment with unsustainably large government did not go well and had to be (largely) undone.

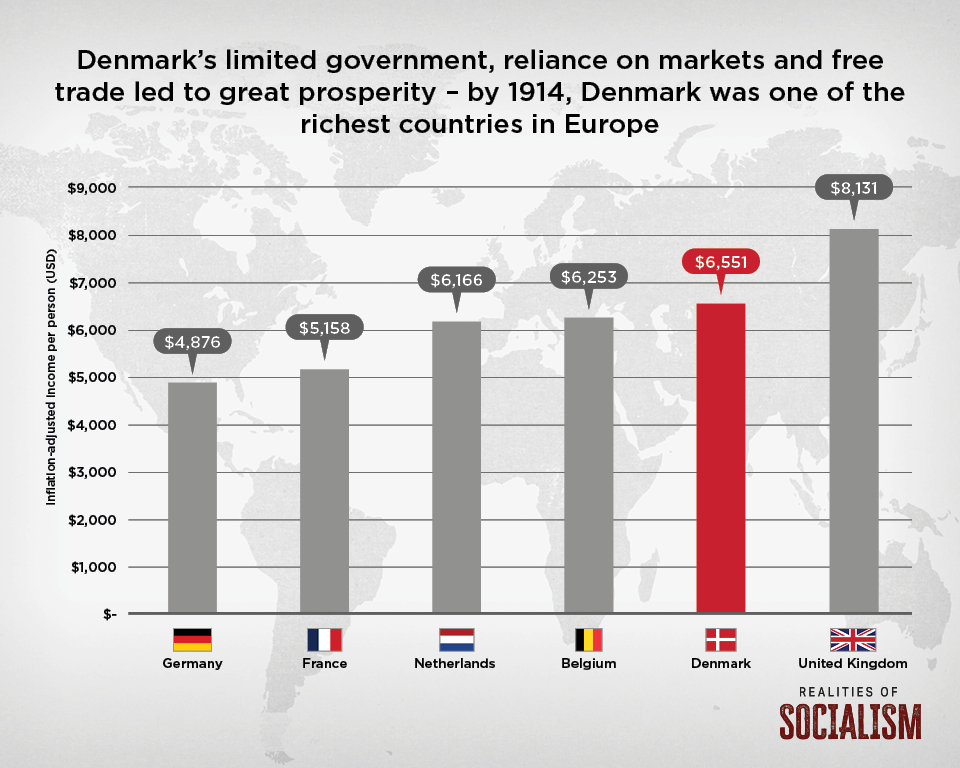

- Chapter 1: Getting Rich Before Becoming A Welfare State

Over the past 150 years, Denmark has largely been an economic success story as a result of its steadfast dedication to free markets, free trade, and private property rights dating back to the 1850s. However, the country has had some major policy setbacks, most notably the major macroeconomic policy mistakes of the 1970s when an explosion of government spending contributed to rapidly increasing wages, serious structural unemployment, relatively rapid price increases, and a balance of payments crisis. - Chapter 2: The Evolution of Denmark’s Distinct Fiscal System

This chapter examines Denmark’s public finances and tax system, and identifies why the country has been able to spend and redistribute at high levels, while at the same time maintaining relatively sound public finances. The chapter also seeks to identify the reasons for Denmark’s long-standing fiscal conservativism. - Chapter 3: The Danish Health Care System—Policy and Performance

This chapter provides a brief overview of the key features and relative performance of Denmark’s health care system, including its use of private insurance and private for-profit care providers, and how Denmark compares to other high-income countries that also provide universally accessible health care. - Chapter 4: Denmark’s Primary and Lower Secondary Education System—Organization, Funding, Performance, and the Motivating Effect of School Choice

This chapter provides an overview of Denmark’s primary and lower secondary education system, its organization, administration, and relative school performance, with additional focus on Denmark’s diverse independent (privately operated) schools. - Chapter 5: Generous and Expensive—An Overview of Denmark’s Income Support System

The income support system in Denmark offers some of the most generous benefits among advanced countries around the world, but it is also one of the most expensive to administer. This chapter examines the system in detail: what it covers, how it’s funded, and how some unique—notably private occupational pensions—allow Danes to have among the highest retirement incomes in the OECD and relatively few poor pensioners.