The Reality of Socialism: Singapore | Mini-Documentary

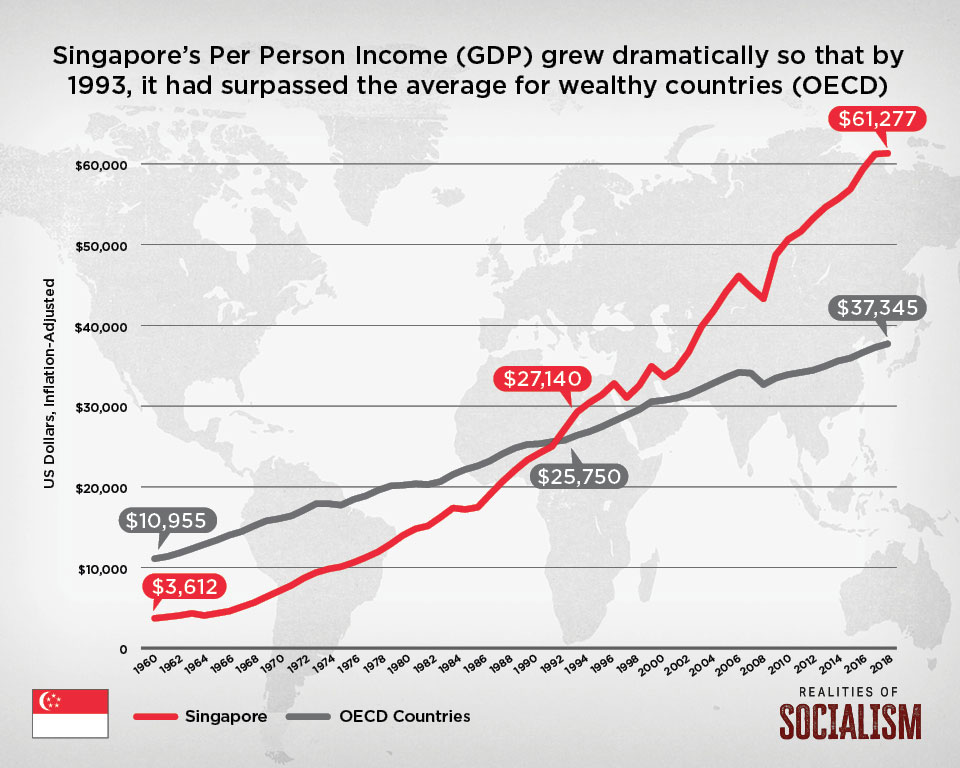

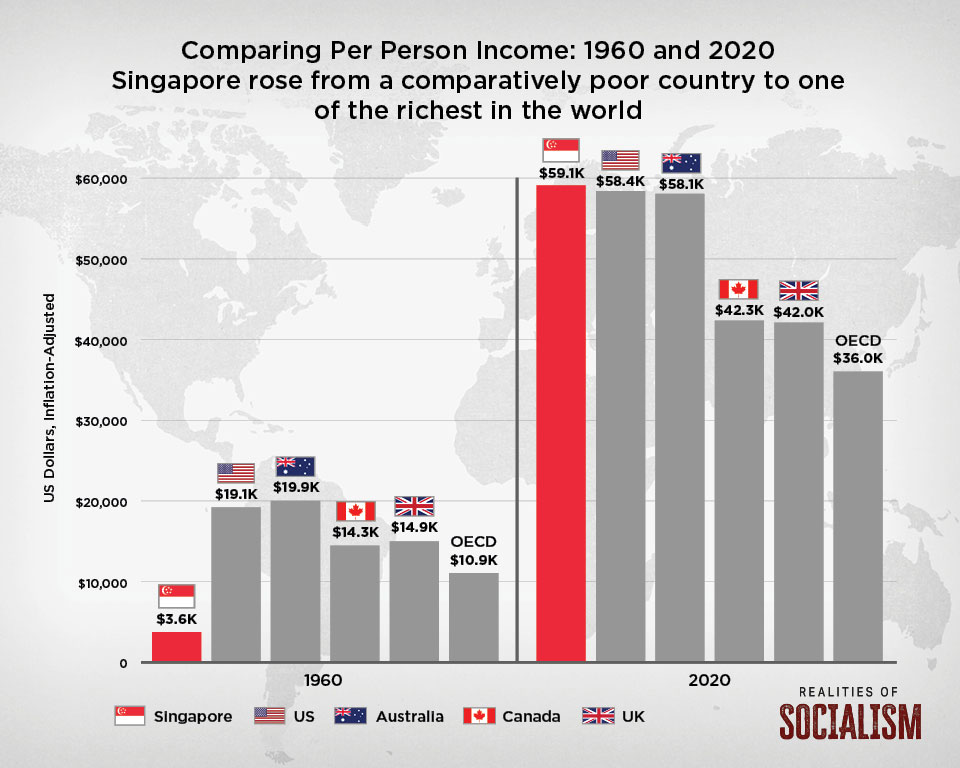

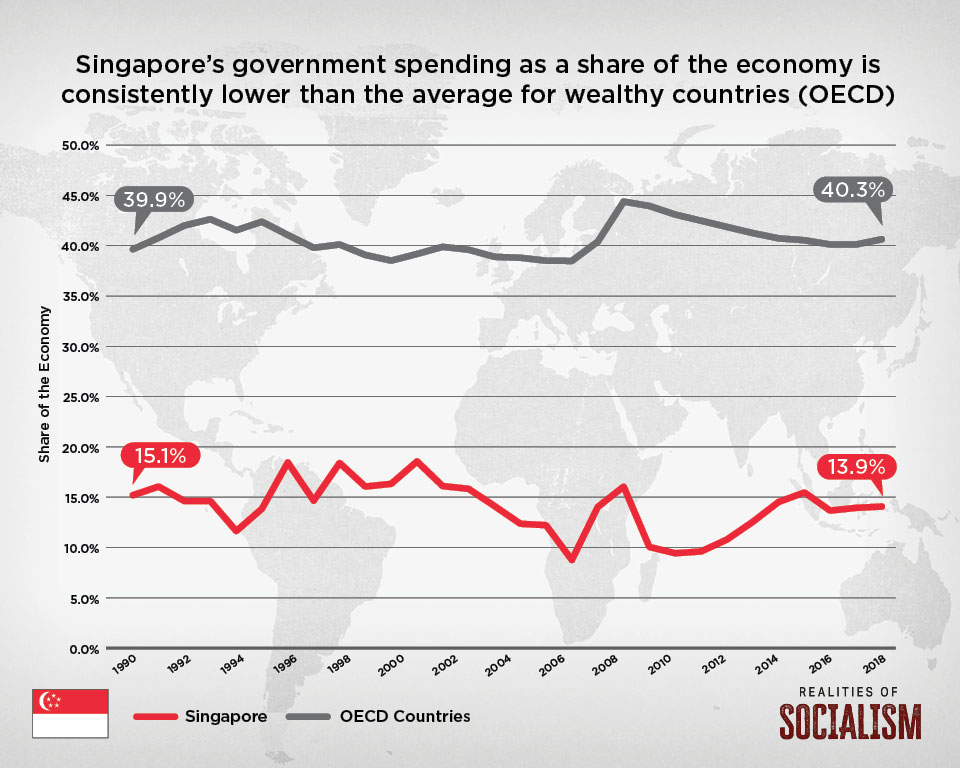

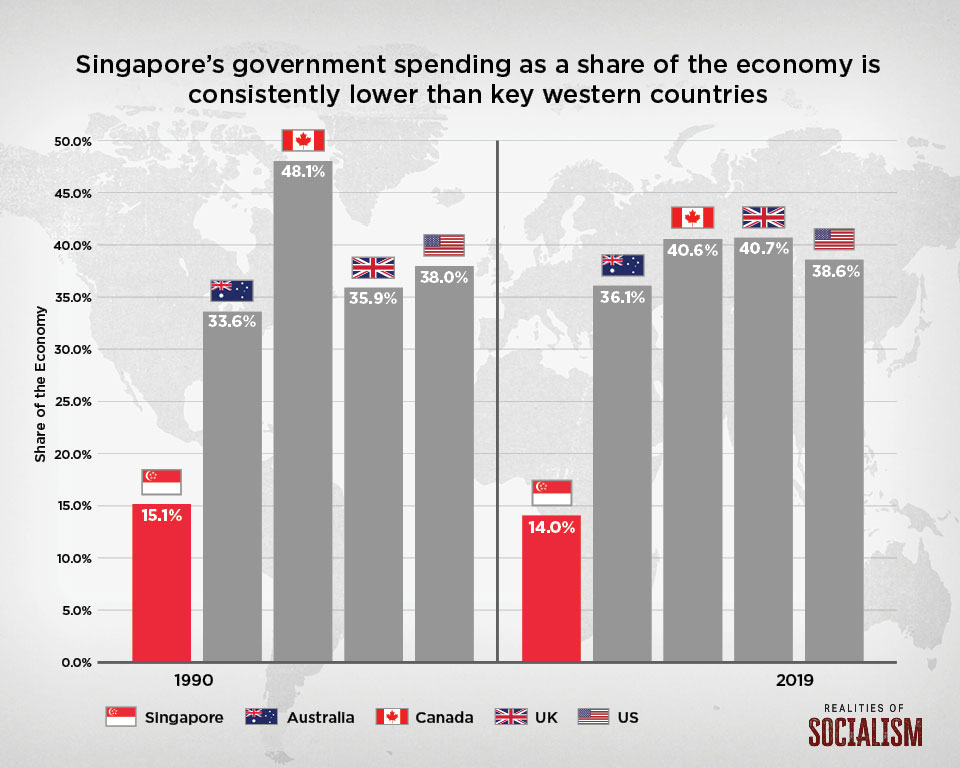

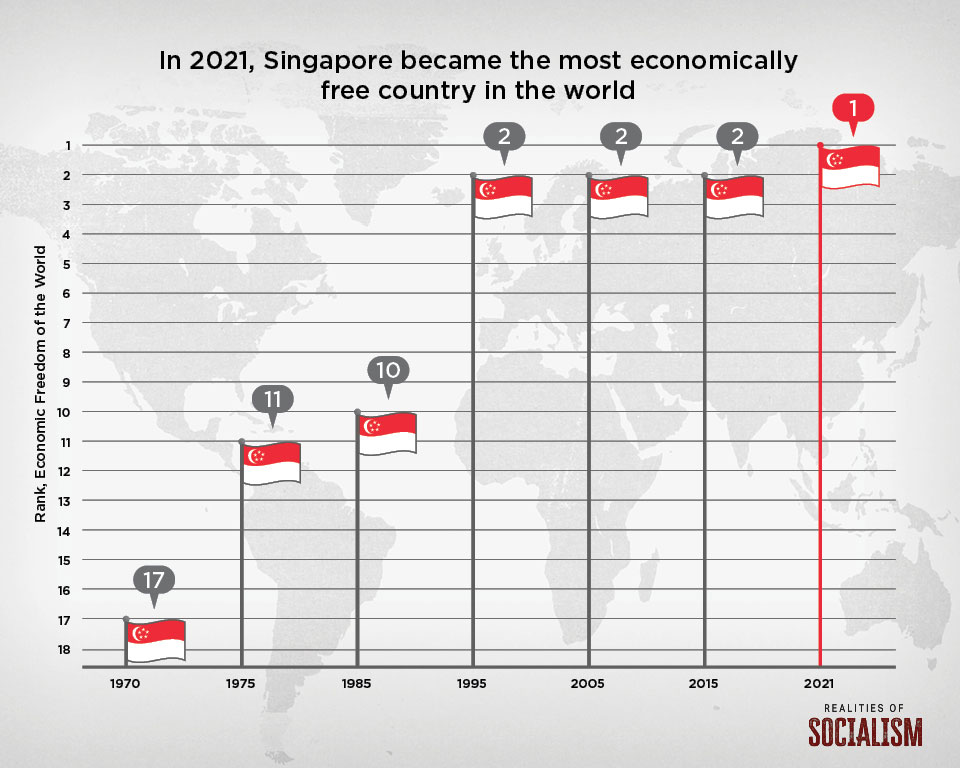

The Wall St. Journal’s Mary O’Grady, along with Fraser Institute Senior Fellow Steven Globerman, explore the stunning economic rise of the small city-state since gaining independence in 1965, and examine how it is able to provide many of the same social services that Westerners do—universal health care, retirement, housing, education, unemployment, for example—but with much smaller government and lower costs. While some have characterized Singapore’s interventionist industrial policies as socialist-style, successive Singaporean governments have actually prioritized growing the economy and raising living standards primarily using market forces rather than government control.

This video is part of a new multimedia project, The Realities of Socialism, by the Fraser Institute in Canada, the Institute of Economic Affairs in the UK, the Institute of Public Affairs in Australia and the Fund for American Studies in the U.S.

More VideosPodcast

Realities of Socialism: The Unique Case of Singapore

Steven Globerman, Senior Fellow and the Addington Chair in Measurement at the Fraser Institute, joins host Rosemarie Fike to discuss the unique case of Singapore' economic and social system, and how their particular economic circumstances and history leave many people wondering.

Videos

Infographics

- All

Explore the book

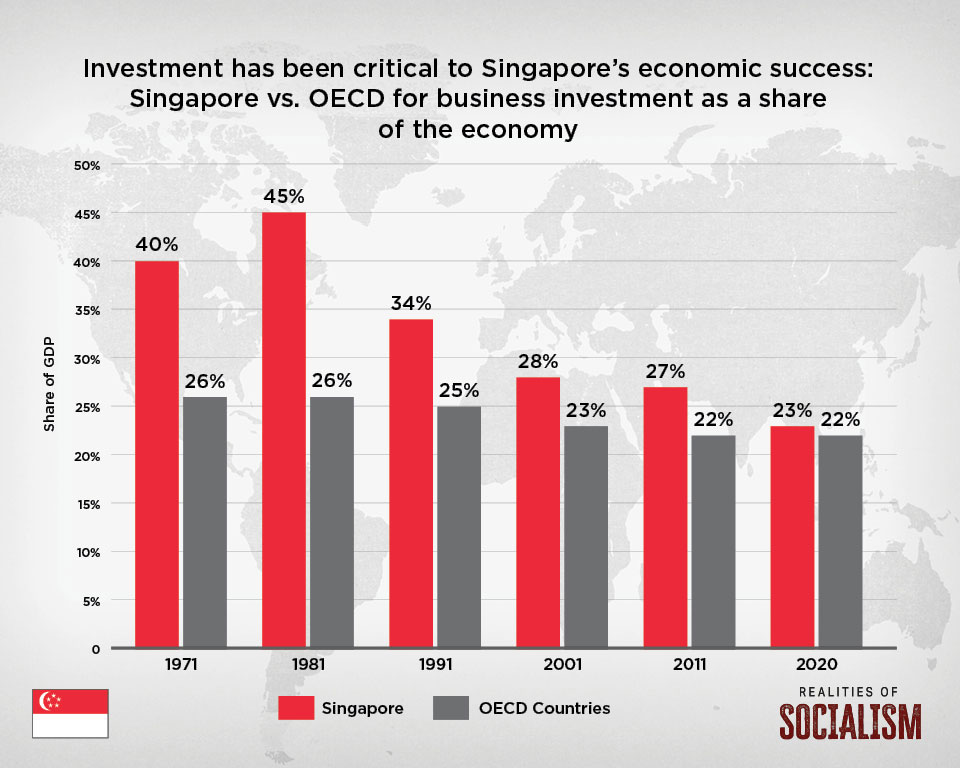

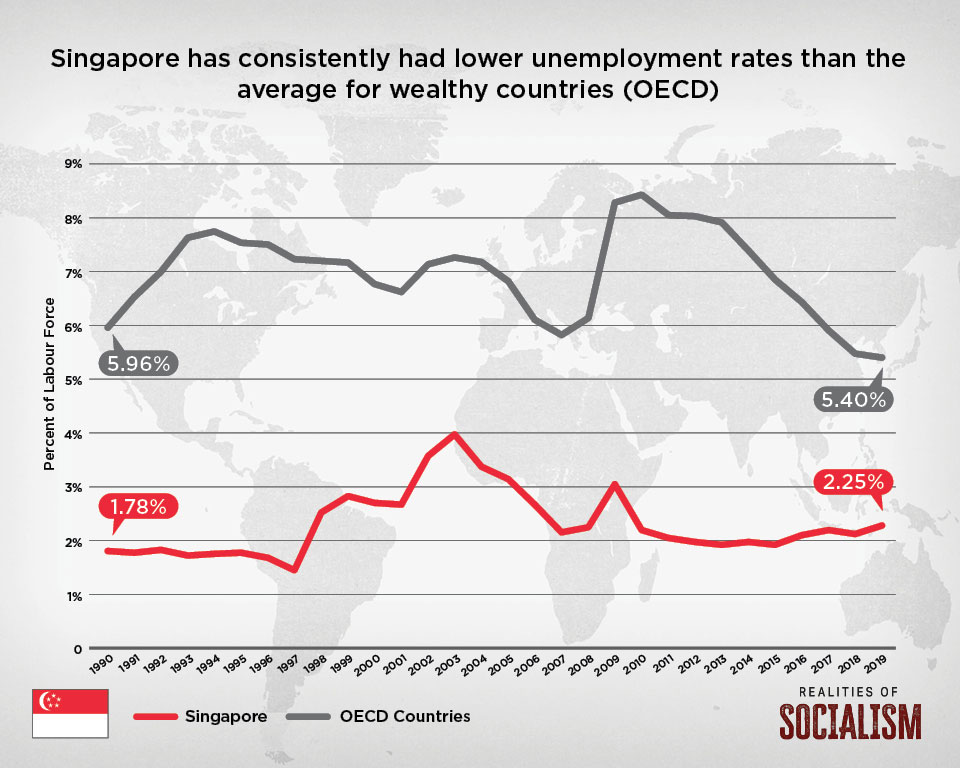

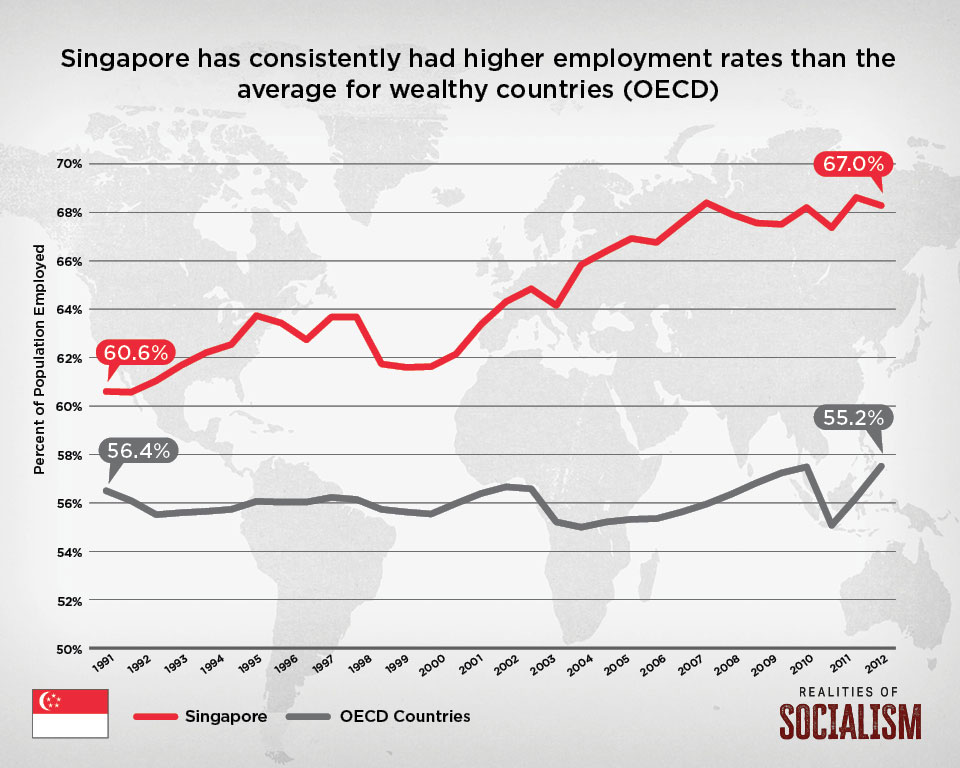

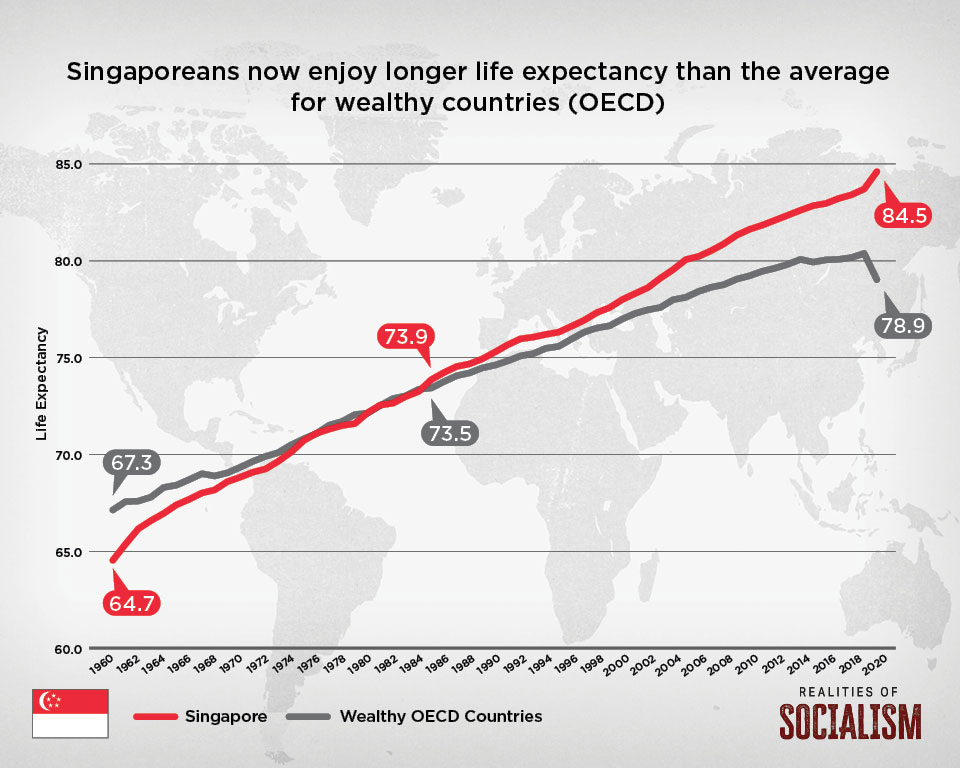

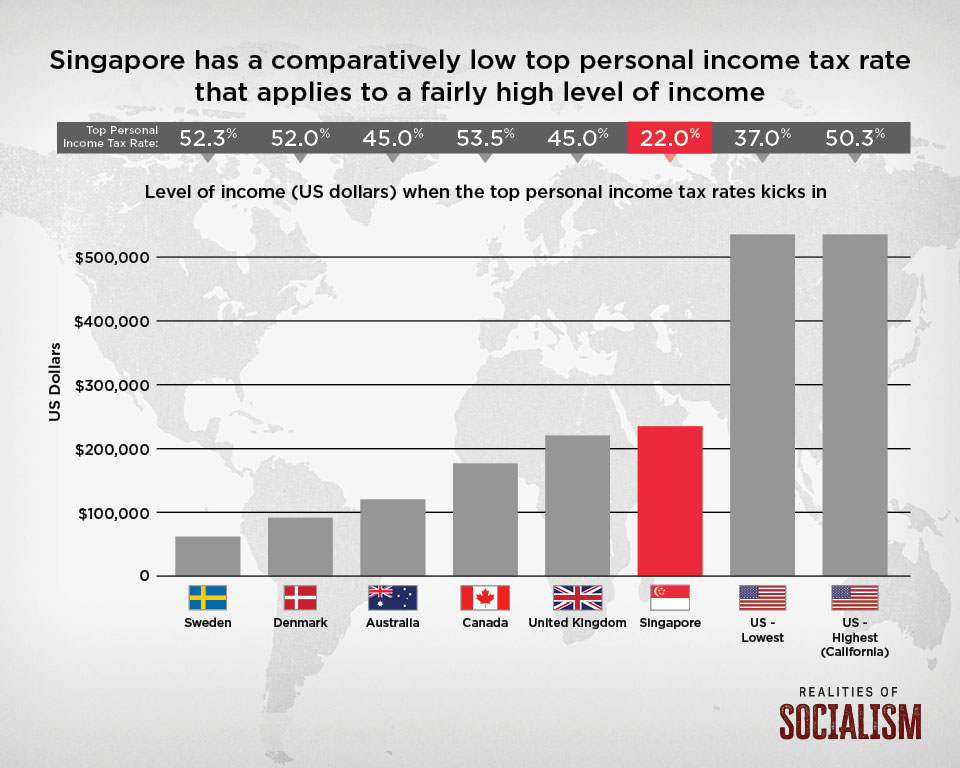

Meritocracy, Personal Responsibility, and Encouraging Investment: Lessons from Singapore’s Economic Growth Miracle documents the stunning economic rise of the small city-state since gaining independence in 1965, and examines how it is able to provide many of the same social services that Westerners do—health care, retirement, housing, education, unemployment, for example—but with much smaller government and lower costs.

- Chapter 1: An Overview of Singapore’s Development and Public Policies

This chapter discusses the evolution and uniqueness of Singapore’s economic and social policies, from British colony to independent city-state. - Chapter 2: Singapore’s Economic Performance

Known as one of the four Asian Tigers, Singapore’s stunning economic success is documented here and compared to other Asia-Pacific countries, as well as the United States. - Chapter 3: The Singaporean Health Care System: Policy and Performance

Singapore’s approach to universal health care represents a departure from much of the developed world in terms of design and philosophy, which shares features of both tax-funded systems, where government is the primary insurer, and social health insurance systems with competitive insurance markets. - Chapter 4: Singapore’s Primary and Secondary Education System: The Use of Education Savings Accounts to Fuel Student Achievement

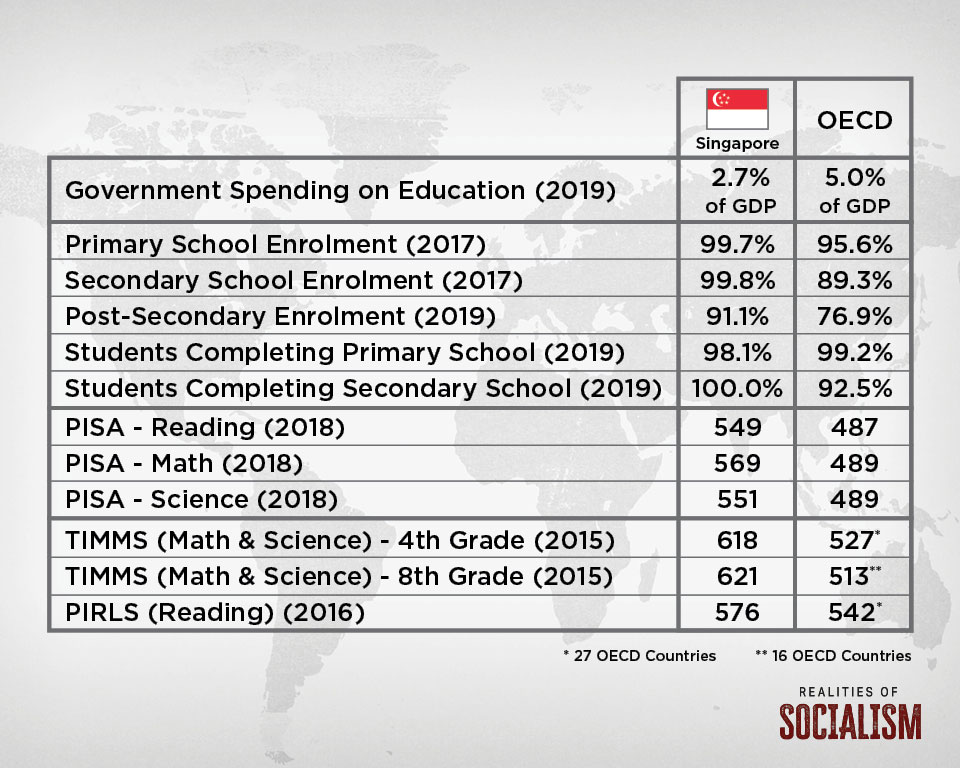

This chapter examines the unique features of Singapore’s education system: Its history, its focus on competition and academic rigour, the Edusave Accounts, and how it routinely evaluates not just students, but also teachers and schools for performance. - Chapter 5: Singapore’s Income-Support System: One of a Kind

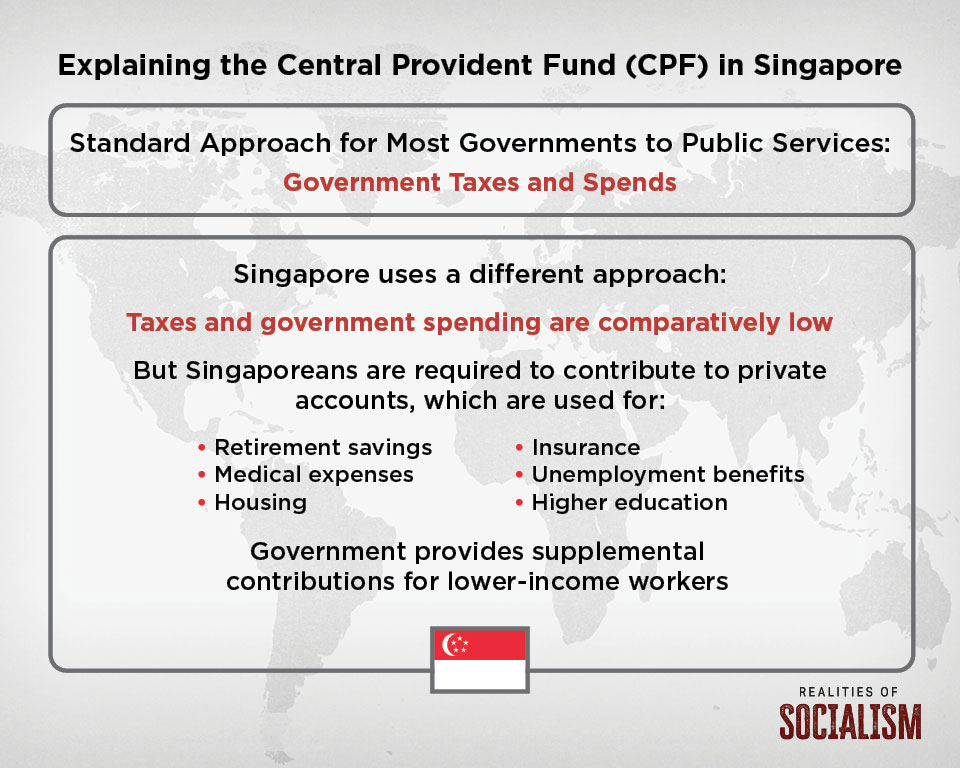

The Singaporean social security system is quite different from those of most other industrialized countries, because it largely emphasizes individual responsibility rather than collective welfare. This chapter discusses Singapore’s unique forced saving model—the Central Provident Fund. - Chapter 6: Is Singapore a Free Market Economy?

This chapter explores the ways Singapore is and is not a market-based economy, where it falls short on liberal democratic values, and discusses what lessons western countries can learn from Singapore's experience.